Alright, let’s be real. Budgeting isn’t exactly the sexiest topic. It’s right up there with flossing or cleaning out your garage. But here’s the thing: getting your money right changes everything. I’m not talking about living like a hermit or skipping every latte (because let’s be honest, coffee is survival). I’m talking about real, doable strategies that make your money work for you

I used to suck at budgeting. Like, “How did I overdraft buying ramen?” levels of bad. But over time—through trial, error, and a lot of facepalms—I figured out what works. So grab your drink of choice, kick back, and let me walk you through some budgeting wisdom from someone who’s been in the trenches.

Step 1: Know What’s Coming In (Yeah, Seriously)

This seems obvious, but you’d be surprised how many of us don’t actually know how much we really make after taxes. Pull out your pay stubs or check your bank account deposits. If your income varies month to month, figure out your average over the last 3-6 months.

Now you’ve got your number. That’s your starting point. Your financial North Star.

Step 2: Track Everything You Spend for 30 Days

Everything. That random $5 donut run? That $1.99 app subscription you forgot about? Track it. You don’t need a fancy spreadsheet (unless you’re into that). Apps like Mint, YNAB (You Need A Budget), or even just your notes app work great.

This part feels annoying at first. But after 30 days, you’ll see exactly where your money is leaking. It’s like turning the lights on in a messy room. Suddenly, it all makes sense.

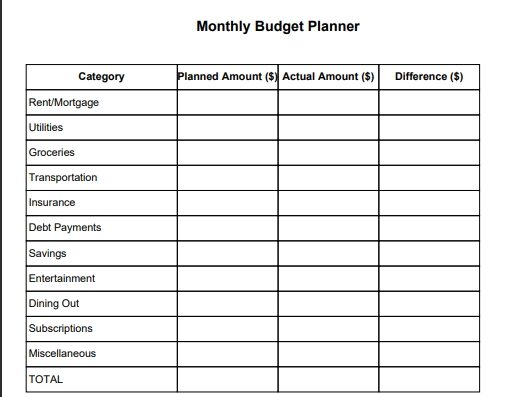

Step 3: Categorize Your Expenses

Now that you’ve tracked your spending, break it down into categories:

- Fixed Costs (rent, car payment, insurance)

- Variable Costs (groceries, gas, eating out)

- Non-Essentials (subscriptions, impulse buys, hobbies)

Once you see where your money’s going, it’s easier to figure out what needs adjusting.

Step 4: Build a Budget That Doesn’t Suck

Here’s where people usually tap out. Budgets don’t have to be super strict or boring. Think of it as telling your money where to go before it disappears.

Here’s a simple framework:

- 50% Needs

- 30% Wants

- 20% Savings/Debt Payoff

Not feeling that structure? Cool. Make your own rules—just make sure you’re covering essentials and putting something toward savings or debt.

Step 5: Automate What You Can

Life is busy. The fewer decisions you have to make about money, the better. Set up automatic transfers to savings, automatic bill pay, and autopilot your debt payments if possible.

Out of sight, out of mind. But in the best way.

Step 6: Use Cash for the Stuff You Overspend On

For me, it was eating out. I’d swipe my card like I was Oprah handing out cars. So I tried the envelope system: put a set amount of cash in an envelope for eating out, and when it’s gone, it’s gone.

Weirdly effective. Painful, but effective.

Step 7: Plan for the “Oh Crap” Stuff

Car repairs, medical bills, vet visits—you know they’re coming eventually. So start a sinking fund: a separate savings account you add to each month for those inevitable hits.

Even $25/month makes a difference. It’s like future-you giving present-you a high five.

Step 8: Make Room for Fun

Yes, seriously. Budgeting isn’t about suffering. If you cut out all the fun, you’ll rebel eventually and blow your budget on something wild (ask me about the $300 sushi night I “deserved”).

Build in some guilt-free spending money. Your mental health will thank you.

Step 9: Review and Adjust Monthly

Life changes. Your budget should too. Sit down once a month, look at what worked, what didn’t, and adjust. No shame, no guilt. Just tweak and move forward.

Step 10: Celebrate Small Wins

Paid off a credit card? Stuck to your grocery budget? Added to your emergency fund? Celebrate it! Budgeting isn’t about perfection; it’s about progress.

Bonus Tips (Because You Know I Got More)

- Meal plan: You’ll save hundreds and waste less food.

- Use cashback apps: Rakuten, Ibotta, Honey. Free money.

- Cut one subscription a month: You probably won’t even miss it.

- Buy used: Facebook Marketplace is the GOAT.

- Use the “48-hour rule”: Wait two days before buying non-essentials. Most of the time, you won’t even want it anymore.

Final Thoughts

Look, budgeting isn’t about being perfect. It’s about being intentional. Your money should work for you, not the other way around.

It took me years to figure out a rhythm that didn’t feel like punishment. But once I did? Game changer. I stress way less about money. I sleep better. I feel more in control.

You don’t need to overhaul your life overnight. Just pick one thing from this post and try it for a week. Then build from there.

You got this.

- 60PCS Budget Sheets with holes for a6 binders, 4 colors, 15 for each color, which can meet your daily expense tracker an…

- SKYDUE budget sheets include purple, blue, green and pink, different colors of budget sheets can be used for different b…

- Double-sided design budget sheets can be used on both sides, making it more space to provide daily expense tracking.

- While other budget tracker sheets are too thin, too large or simply get damaged easily, The Lamare weekly budget planner…

- Who has the time to organize their expenses at the end of each month? With these budget binder accessories sheets or a6 …

- No more overspending without realizing it! Start saving money naturally by tracking your expenses daily. As your balance…

- Flexible Financial Control: this money place holders cash stuffing comes with 6 designated denominations, namely 50 doll…

- Well Sized for Convenience: with an ideal size of about 6.3 x 2.76 inches, larger than standard size dollar bills, these…

- Long Lasting Quality: made from polypropylene material, these cash holders are designed to resist wear and tear; Please …